s corp tax calculator nyc

Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state one. Being Taxed as an S-Corp Versus LLC.

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Lets start significantly lowering your tax bill now.

. All shareholders who earn wages or a salary from a C Corporation must pay self-employment tax. Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax.

New York Estate Tax. If your business is incorporated in New York State or does business or participates in certain other activities in New York State you may have to file an annual New York State corporation tax return to pay a. This tax calculator shows these values at the top of your results.

For example in New York an S-Corp would be subject to the citys 885 business tax in addition to state and federal taxes. This is why it is imperative for those considering an S-corp to be. C-Corp or LLC making 8832 election.

New York Salary Tax Calculator for the Tax Year 202223. Normally these taxes are withheld by your employer. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

For example if you pay yourself. You are able to use our New York State Tax Calculator to calculate your total tax costs in the tax year 202223. See S corporations - tax years beginning before January 1 2015 for S corporation information for years prior to corporate tax reform.

The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. A 10000 reduction applies to all capital tax calculations provided that the capital tax cannot be less than 0. This could potentially increase the S-corp tax bill significantly and essentially wipe out the other tax advantages offered by this entity structure.

New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. When taxing capital the rate is 015 with a cap payment of 1 million.

Total first year cost of. Estimated Local Business tax. Another way that corporations can be taxed is directly on their business capital less certain liabilities.

Smaller businesses with less net income will only have to pay 65. With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid. Fixed Dollar Minimum FDM Amounts.

Youre guaranteed only one deduction here effectively making your Self-Employment tax 1413 or 7065. After the state makes a few adjustments to the amount the taxes will then be paid at 71. See TSB-M-15 7C 6I for additional information on the impact of corporate tax reform on New York S corporations and their shareholders.

Check each option youd like to calculate for. New York may also require nonprofits to file additional paperwork with the New York Department of Revenue to gain exemption from New Yorks corporate taxes. If you are self-employed you have to pay both the employer and employee portion which was 153 in 2016.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Overview of New York Taxes. However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only.

Federal Taxes for C Corps. The current self-employment tax rate is 153 percent. Compare this to income taxation for this person at 5235 without deductions taken.

Enter the estimated yearly net income for the business. This tax is also known as the FICA Medicare or social security tax and is levied on your entire income. Enter the salary you would pay yourself if an S-Corporation.

Annual cost of administering a payroll. Our calculator has been specially developed in. Finance Memoranda 16-4 Transitional Filing Relief for Taxpayers Affected by New York Citys Corporate Tax Reform Legislation Finance Memoranda 17-2 -Tax on.

S corps are not taxed at the business level so there is no double taxation as in a C corporation. If your shareholders have made an S election for federal purposes you. New Yorks estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows.

Read ahead to calculate your S corp tax savings when compared to a default LLC. This could potentially significantly increase S-Corps tax bill and essentially wipe out the other tax benefits that this corporate structure offers. An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and local income tax purposes that is elected by either an LLC or a corporation.

Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022. This tax is administered by the Federal Insurance Contributions Act FICA and covers Social Security Medicare and other benefits. The exemption for the 2021 tax year is 593 million which means that any.

Our S Corp vs. If youre new to personal taxes 153 sounds like a lot less than the top bracket of 37. Partnership Sole Proprietorship LLC.

If New York City Receipts are. A sole proprietorship automatically exists whenever you are engaging in business by and for yourself without the protection of an LLC Corporation or Limited Partnership. Start Using MyCorporations S Corporation Tax Savings Calculator.

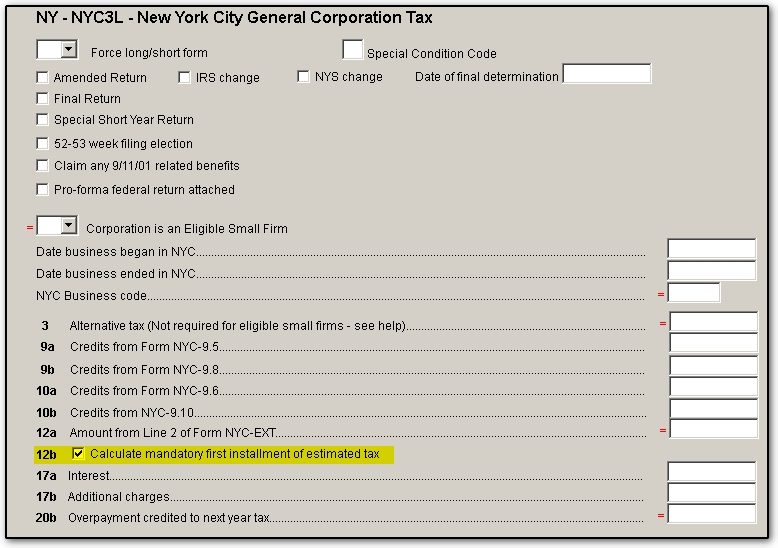

Now if 50 of those 75 in expenses was related to meals and. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the US.

Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. Annual state LLC S-Corp registration fees. LLC Tax Calculator guide will explain how to tell whether an S corp election is right for your business.

S-Corp or LLC making 2553 election. S Corporation Subchapter S and S Corp Tax Rate. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C.

You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. These corporations will continue to file GCT tax returns in tax years beginning on or after January 1 2015 if they are. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

If youre a solopreneur making at least 100000 and 10000 in annual distributions use Collective to start your S corp. How much can I save. What percent of equity do you own.

In order to gain New York tax-exempt status a corporation must qualify as a 501c and obtain a Nonprofit Tax-Exempt ID Number from the IRS.

A Frozen Bank Account Is A Bank Account That You Cannot Access Because A Creditor Has Placed A Restraint On Credit Card Online Bank Account Student Information

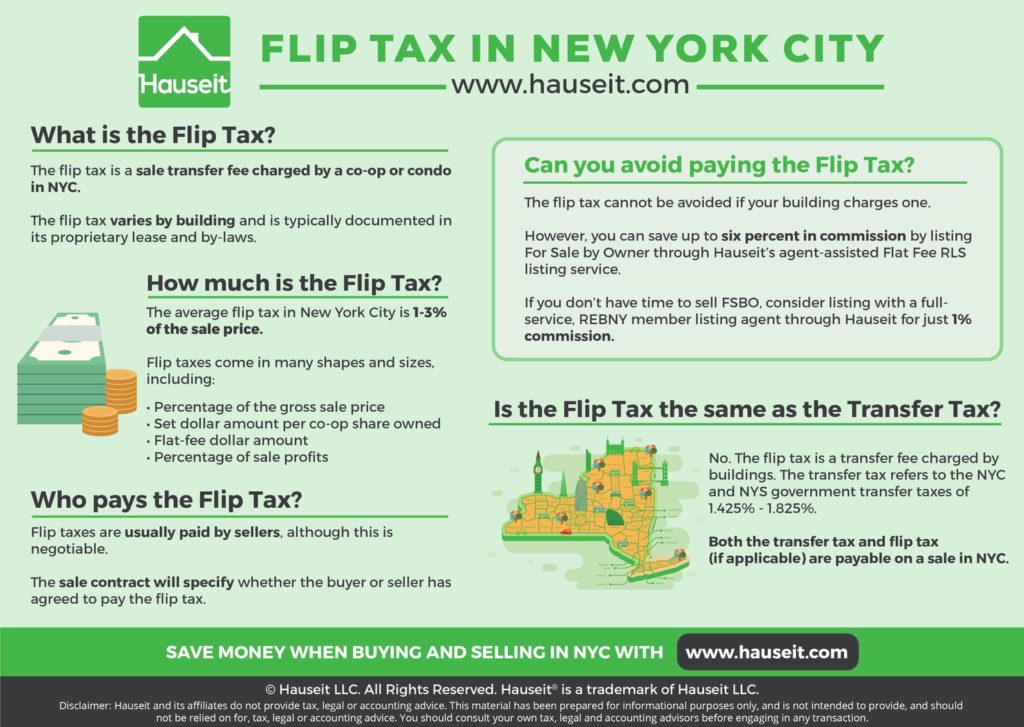

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

Chinese Microsoft Windows 8 Consumer Preview Screenshots Leak Microsoft Microsoft Windows Windows

Is It Worth Buying A Coop In Nyc Hauseit Nyc Buying A Rental Property Buying A Condo

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

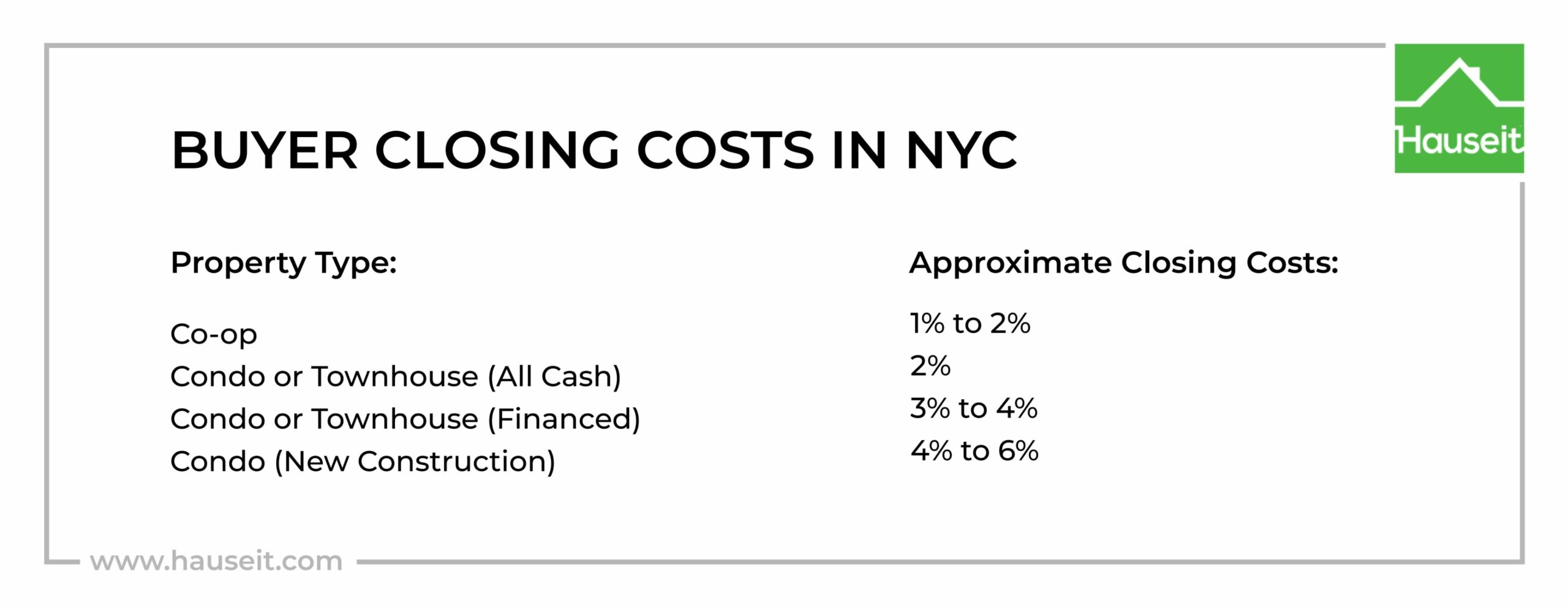

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Co Op Maintenance Tax Deduction Calculator Interactive Hauseit

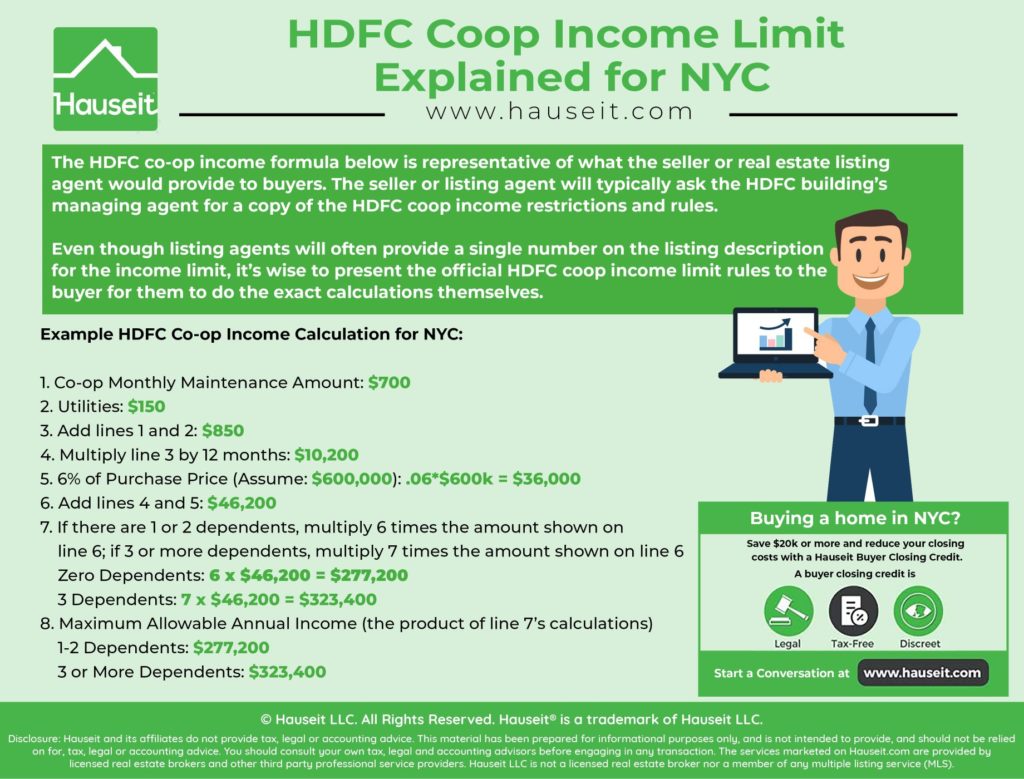

Hdfc Coop Income Limit Explained For Nyc Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Ny State And City Payment Frequently Asked Questions

Flip Tax In Nyc What Is The Average Flip Tax And Who Pays It Hauseit

New York City Taxes A Quick Primer For Businesses

Ny State And City Payment Frequently Asked Questions